The Federal Home Loan Banks of Atlanta, Cincinnati, Indianapolis, Pittsburg, and Seattle play a crucial role in providing funding, community lending, and other banking services to meet their communities’ credit needs, expand housing opportunities, and drive economic development. As part of a national network of more than 7,700 financial institutions and 12 District Banks, they support community-based financial institutions nationwide by offering loans and essential services.

Empowering Mortgage Acquisition Through Digital Innovation

Case Study

Empowering Mortgage Acquisition

Through Digital Innovation

The Customer

And Their Challenge

To enhance operational efficiency, these Federal Home Loan Banks required a web-based system to automate contracting, purchasing, and tracking the delivery of mortgages from their member banks, credit unions, and other financial institutions. This solution aimed to streamline processes, improve accountability, and ensure timely mortgage delivery across their vast network.

The Solution

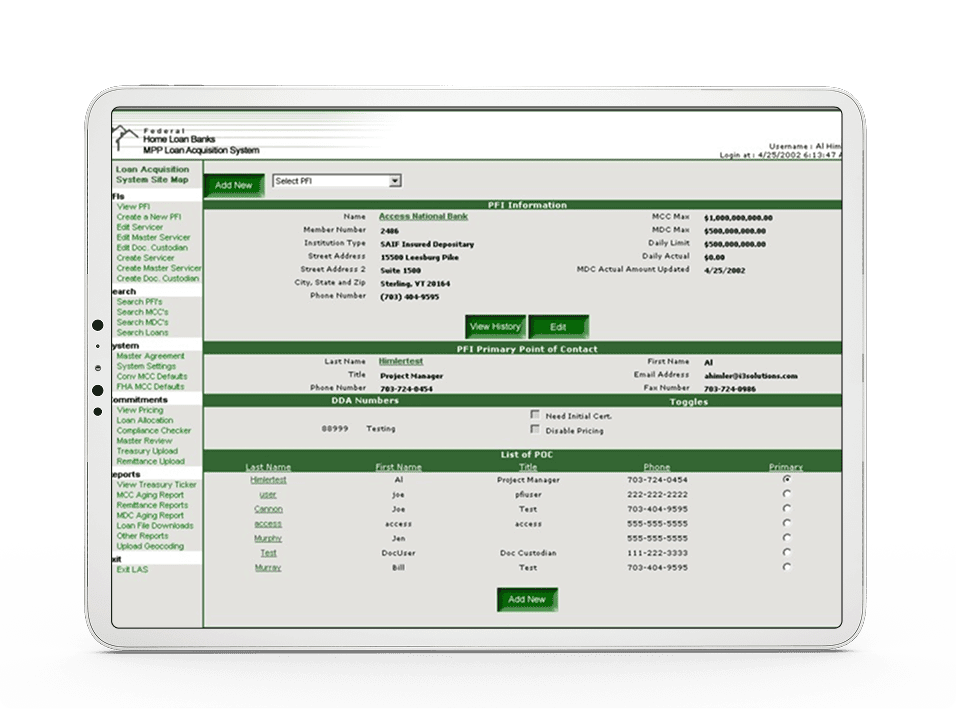

i3solutions developed a cutting-edge online application known as the Loan Acquisition System (LAS) to streamline the process by which Federal Home Loan Banks (FHLBs) purchase mortgages from their Participating Financial Institutions (PFIs). LAS provides PFIs with a comprehensive platform to retrieve current pricing from the FHLBs, commit to delivery contracts, and deliver loan pools efficiently. The system features a complex rules engine that enables PFIs to seamlessly upload and validate loans, providing instant feedback on the success or failure of each upload along with descriptive information on any issues encountered. In addition, online analytic tools empower PFIs to determine

which of their loans best fit the criteria outlined in each delivery contract, enhancing decision-making and contract fulfillment.

The Loan Acquisition System not only facilitates smoother interactions between PFIs and FHLBs but also allows FHLBs to effectively purchase loans and manage their loan warehouse. By automating contracting, purchasing, and tracking processes, LAS reduces manual intervention, minimizes errors, and accelerates the overall transaction cycle. This robust system ensures that both PFIs and FHLBs can operate more efficiently, with enhanced visibility into loan transactions and streamlined workflows that support ongoing business growth and customer satisfaction.

Technologies

Used in the Solution

Measurable Benefits

and Business Impact

The Federal Home Loan Banks are reaping significant benefits from a sophisticated system that expertly manages over $40 billion in mortgages. This intricate solution grants Participating Financial Institutions real-time access generates timely and actionable reports, tracks and analyzes loans comprehensively, and automatically validates information against stringent mortgage industry standards.

By automating complex tasks and ensuring compliance, this user-friendly platform not only saves valuable administrative time but also reduces costs and boosts overall productivity. The enhanced efficiency allows both FHLBs and their PFIs to focus on strategic priorities and improved customer service, reinforcing the system’s value as a critical asset in managing large-scale mortgage operations.

Empowers FHLBs to purchase mortgages from member banks of any size. This flexibility ensures that both large and small financial institutions can participate fully, broadening the scope of available mortgage products and fostering a more inclusive financial ecosystem.

Provides comprehensive tracking of the mortgage pipeline. By offering detailed visibility into each stage of the process, the system allows FHLBs to anticipate bottlenecks, optimize workflow, and make data-driven decisions to enhance operational efficiency.

Enhances customer service with real-time pricing and streamlined data transfer. This immediate access to current pricing data improves transparency and trust, while the simplified data exchange process reduces errors and accelerates transaction times, resulting in a smoother client experience.

Customer Says

Solving complex problems is clearly a strength for i3solutions. In developing a multitasked, Internet-based system for a new wholesale mortgage program for three Federal Home Loan Banks, their project management and final product delivery proved to be highly successful. The team was able to prioritize requests from the three customers, solve separate platform issues, and create a key functional component of our business.