Brown Advisory, an independent investment management and strategic advisory firm, specializes in active public equity and fixed income strategies, serving a diverse range of clients, including individuals, families, nonprofits, institutions, and financial intermediaries worldwide. To uphold its commitment to reliability and trust, the firm recognized the need to streamline processes and workflows for managing critical client data. Developing an efficient cash processing system to manage client portfolios and transactions was essential, but the complexity of the task, coupled with the lack of a dedicated software methodology and expertise in building or integrating advanced business processes, required external support.

Managing Client Money with a Streamlined Cash Processing System

Case Study

Managing Client Money With a

Streamlined Cash Processing System

The Customer

And Their Challenge

The Solution

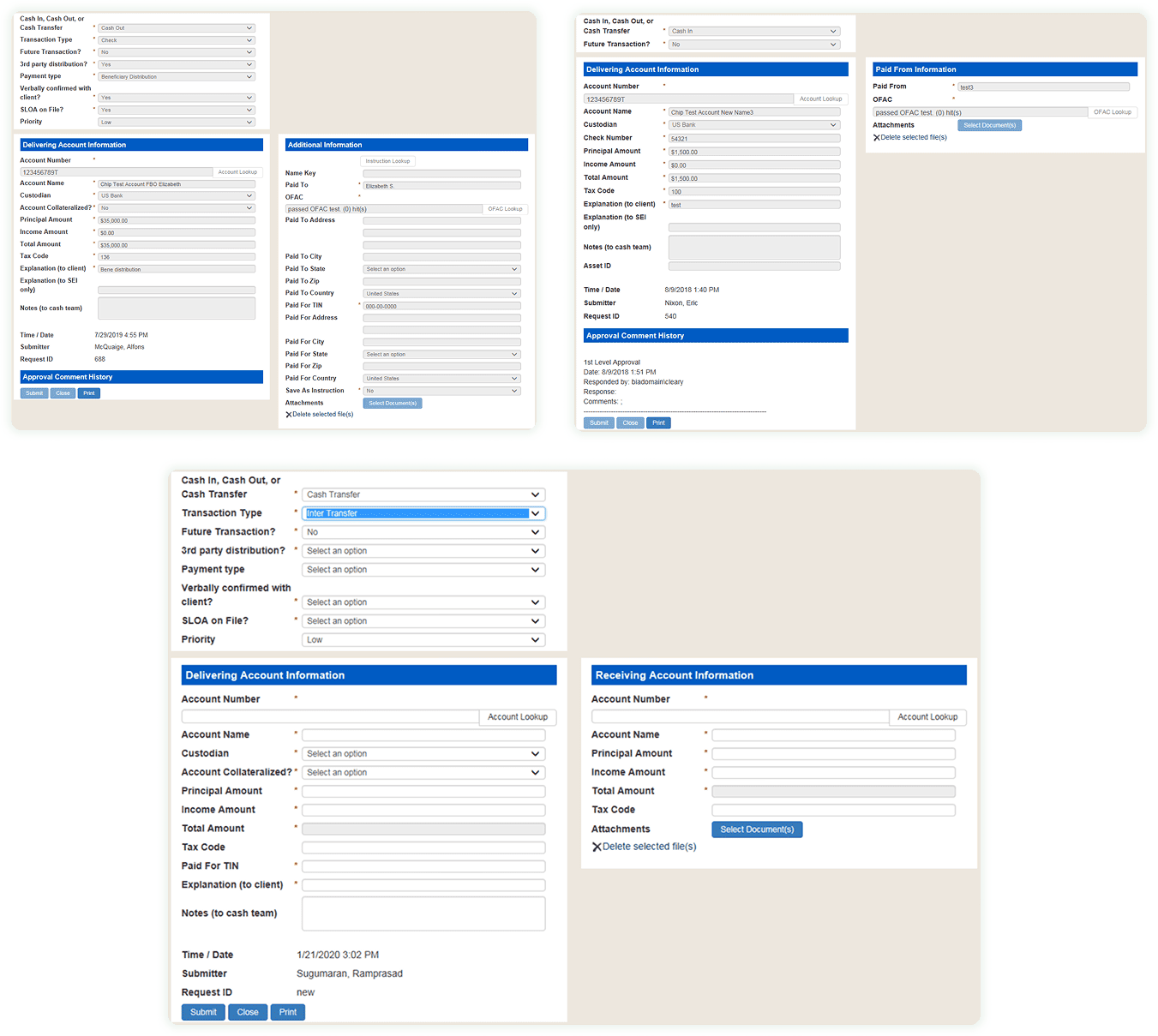

To help Brown better manage its clients’ finances, i3solutions designed and implemented a custom Cash Processing System tailored to align with their critical business processes and workflows. This robust application was built to handle four distinct transaction types, each following its own unique process, ensuring the system could address the complexity of the client’s financial operations. Recognizing the absence of an existing software development methodology, we introduced a comprehensive approach that is now utilized across all SharePoint and custom application development projects within the firm. This methodology has become a cornerstone for future technology initiatives, enabling consistent and efficient development practices.

The foundation of our solution began with detailed assessment, planning and visualization. We collaborated closely with the client’s cash team to document internal processes, developing comprehensive process maps and wireframe diagrams to capture the systems and workflows to be automated. These visual standards provided a clear roadmap for implementation, ensuring the new system aligns seamlessly with existing operational needs. From these insights, we led the development of workflow solutions to streamline and automate Brown’s cash processing, leveraging SharePoint and Nintex workflows—the most complete platforms for process management and automation.

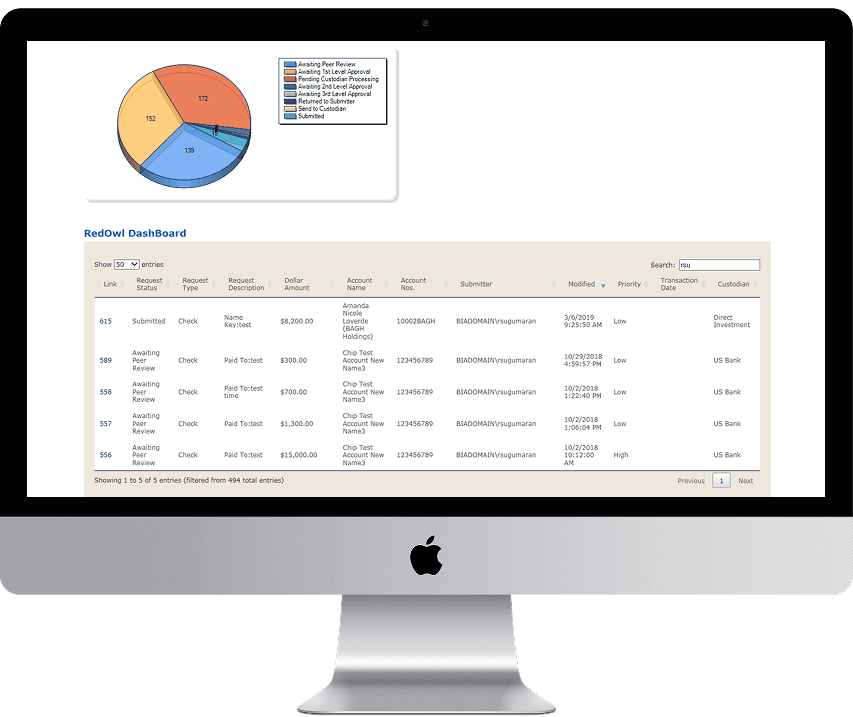

Our efforts extended to seamless platform integration, a critical aspect of the project’s success. The new Cash Processing System was flawlessly integrated with Galileo and APX, two vital platforms central to the firm’s daily portfolio and client relationship management. Additionally, we incorporated RedOwl, the client’s external security analytics platform, into the application’s architecture. The system was configured to send transaction data to RedOwl for real-time risk assessment. Once RedOwl determined the risk level, the application retrieved this information, enabling the cash team to process transactions efficiently while minimizing risk.

By delivering a fully integrated, automated solution, i3solutions empowered Brown to optimize its financial operations and better serve its clients. The robust workflows, streamlined processes, and enhanced risk management capabilities provided by the new Cash Processing System have allowed the firm to achieve its operational goals while reinforcing its commitment to reliability, accuracy, and trust.

Technologies

Used in the Solution

Measurable Benefits

and Business Impact

Streamlined Operations and

Increased Efficiency

The Cash Processing System automated complex workflows, significantly reducing manual effort and processing times for all four transaction types. This allows the cash team to focus on higher-value tasks, improving overall productivity and operational efficiency.

Enhanced Risk

Management

By integrating with RedOwl, the system enables real-time risk assessment for transactions, minimizing exposure to potential risks and ensuring that transactions are processed securely and accurately.

Seamless Integration Across

Platforms

The system’s flawless integration with Galileo, APX, and RedOwl ensures consistency and accuracy across platforms, enhancing the firm’s ability to manage portfolios and client relationships while maintaining robust security measures.

Improved Scalability and Adaptability

With the introduction of a software development methodology, the client gained a standardized approach to future SharePoint and custom application development projects, ensuring scalability and adaptability to evolving business needs.

Cost Savings and Operational Reliability

Automating workflows and centralizing cash processing reduces administrative costs, minimizes errors, and provides a reliable platform for managing critical financial operations, ultimately enhancing client satisfaction and reinforcing trust.